Watch This Video to learn more

Collinsville Newsfeed Sunday November 2, 2025

Page 5

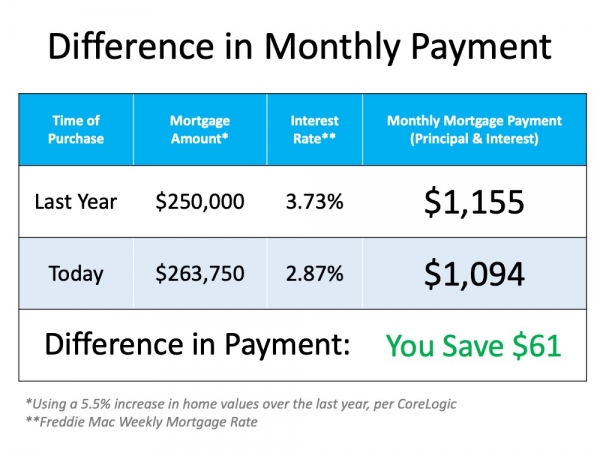

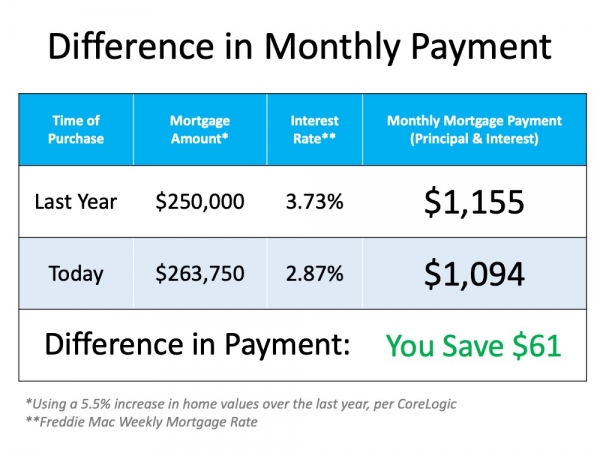

The Cost of a Home Is Far More Important than the Price

posted by: George Sykes, Managing Broker, Worth Clark Realty on Tuesday September 29, 2020

Housing inventory is at an all-time low. There are 39% fewer homes for sale today than at this time last year, and buyer demand continues to set records. Zillow recently reported: ...

Read Full Article ...The Cost of a Home Is Far More Important than the Price

posted by: George Sykes, Managing Broker, Worth Clark Realty on Tuesday September 29, 2020

Housing inventory is at an all-time low. There are 39% fewer homes for sale today than at this time last year, and buyer demand continues to set records. Zillow recently reported: ...

Read Full Article ...Busey Wealth Management Expands Services in Metro East

posted by: Busey Bank on Tuesday September 22, 2020

Team Adds Advisors to Serve Clients in Madison, St. Clair and Surrounding Counties

Busey Wealth Management has expanded services in the Metro East while recently adding several new team members to help serve the needs of clients throughout Madison, St. Clair and surrounding counties.

Busey Wealth Management Expands Services in Metro East

posted by: Busey Bank on Tuesday September 22, 2020

Team Adds Advisors to Serve Clients in Madison, St. Clair and Surrounding Counties

Busey Wealth Management has expanded services in the Metro East while recently adding several new team members to help serve the needs of clients throughout Madison, St. Clair and surrounding counties.

Home Use is Changing

posted by: George Sykes, Managing Broker, Worth Clark Realty on Wednesday September 9, 2020

We’ve seen a lot of change this year, and many of them have impacted the demands made on our homes.

Home Use is Changing

posted by: George Sykes, Managing Broker, Worth Clark Realty on Wednesday September 9, 2020

We’ve seen a lot of change this year, and many of them have impacted the demands made on our homes.

How Will the Presidential Election Impact Real Estate in Places Like Collinsville?

posted by: George Sykes, Managing Broker, Worth Clark Realty on Wednesday September 2, 2020

The year 2020 will be remembered as one of the most challenging times of our lives. A worldwide pandemic, a recession causing historic unemployment, and a level of social unrest perhaps never seen before have all changed the way we live. Only the real estate market seems to be unaffected, as a new forecast projects there may be more homes purchased this year than last year.

As we come to the end of this tumultuous year, we’re preparing for perhaps the most contentious presidential election of the century. Today, it’s important to look at the impact past presidential election years have had on the real estate market.

How Will the Presidential Election Impact Real Estate in Places Like Collinsville?

posted by: George Sykes, Managing Broker, Worth Clark Realty on Wednesday September 2, 2020

The year 2020 will be remembered as one of the most challenging times of our lives. A worldwide pandemic, a recession causing historic unemployment, and a level of social unrest perhaps never seen before have all changed the way we live. Only the real estate market seems to be unaffected, as a new forecast projects there may be more homes purchased this year than last year.

As we come to the end of this tumultuous year, we’re preparing for perhaps the most contentious presidential election of the century. Today, it’s important to look at the impact past presidential election years have had on the real estate market.

Why Foreclosures Won’t Crush the Housing Market Next Year

posted by: George Sykes, Managing Broker, Worth Clark Realty on Friday August 14, 2020

With the strength of the current housing market growing every day and more Americans returning to work, a faster-than-expected recovery in the housing sector is already well underway. Regardless, many are still asking the question: will we see a wave of foreclosures as a result of the current crisis? Thankfully, research shows the number of foreclosures is expected to be much lower than what this country experienced during the last recession. Here’s why.

Read Full Article ...Why Foreclosures Won’t Crush the Housing Market Next Year

posted by: George Sykes, Managing Broker, Worth Clark Realty on Friday August 14, 2020

With the strength of the current housing market growing every day and more Americans returning to work, a faster-than-expected recovery in the housing sector is already well underway. Regardless, many are still asking the question: will we see a wave of foreclosures as a result of the current crisis? Thankfully, research shows the number of foreclosures is expected to be much lower than what this country experienced during the last recession. Here’s why.

Read Full Article ...Will We See a Surge of Homebuyers Moving to the Suburbs?

posted by: George Sykes, Managing Broker, Worth Clark Realty on Monday August 10, 2020

As remote work continues on for many businesses and Americans weigh the risks of being in densely populated areas, will more people start to move out of bigger cities? Spending extra time at home and dreaming of more indoor and outdoor space is certainly sparking some interest among homebuyers. Early data shows an initial trend in this direction of moving from urban to suburban communities, but the question is: will the trend continue?

Read Full Article ...Will We See a Surge of Homebuyers Moving to the Suburbs?

posted by: George Sykes, Managing Broker, Worth Clark Realty on Monday August 10, 2020

As remote work continues on for many businesses and Americans weigh the risks of being in densely populated areas, will more people start to move out of bigger cities? Spending extra time at home and dreaming of more indoor and outdoor space is certainly sparking some interest among homebuyers. Early data shows an initial trend in this direction of moving from urban to suburban communities, but the question is: will the trend continue?

Read Full Article ...Help Find These Homes in the 618 Area

posted by: George Sykes, Managing Broker, Worth Clark Realty on Wednesday July 29, 2020

Special Offer#: 50106

I'm looking for a few specific homes to sell. I have buyer clients who are ready to purchase, and we can't find the perfect house in the MLS. Maybe you know of a matching property.

Show Special Offering Details ...Local Special

Help Find These Homes in the 618 Area

posted by: George Sykes, Managing Broker, Worth Clark Realty on Wednesday July 29, 2020

I'm looking for a few specific homes to sell. I have buyer clients who are ready to purchase, and we can't find the perfect house in the MLS. Maybe you know of a matching property.

Show Special Offering Details ...Remember Algebra? Things are balanced: Low rates and rising prices.

posted by: George Sykes, Managing Broker, Worth Clark Realty on Wednesday July 29, 2020

Record-low interest rates are balancing out rising prices to keep buyers in the market this summer. DM me to learn more about why buying a home while interest rates are low is so powerful.

Remember Algebra? Things are balanced: Low rates and rising prices.

posted by: George Sykes, Managing Broker, Worth Clark Realty on Wednesday July 29, 2020

Record-low interest rates are balancing out rising prices to keep buyers in the market this summer. DM me to learn more about why buying a home while interest rates are low is so powerful.

How about something Positive? Housing Market Helping Economic Recovery

posted by: George Sykes, Managing Broker, Worth Clark Realty on Thursday July 23, 2020

Special Offer#: 50104

According to Lawrence Yun, Chief Economist at NAR, “This has been a spectacular recovery for contract signings and goes to show the resiliency of American consumers and their evergreen desire for homeownership. This bounce back also speaks to how the housing sector could lead the way for a broader economic recovery.” DM me to learn why 2020 is shaping up to be a strong year to buy or sell a home.

Local Special

How about something Positive? Housing Market Helping Economic Recovery

posted by: George Sykes, Managing Broker, Worth Clark Realty on Thursday July 23, 2020

According to Lawrence Yun, Chief Economist at NAR, “This has been a spectacular recovery for contract signings and goes to show the resiliency of American consumers and their evergreen desire for homeownership. This bounce back also speaks to how the housing sector could lead the way for a broader economic recovery.” DM me to learn why 2020 is shaping up to be a strong year to buy or sell a home.

Bidding Wars ... Real Estate is a Contact Sport This Year

posted by: George Sykes, Managing Broker, Worth Clark Realty on Tuesday July 21, 2020

Special Offer#: 50103

With the number of homebuyers outweighing the number of houses being listed for sale this season, more and more people are facing bidding wars. Whether you’re buying a home or selling your house, DM me to talk about how we can simply and effectively navigate this process together.

Show Special Offering Details ...Local Special

Bidding Wars ... Real Estate is a Contact Sport This Year

posted by: George Sykes, Managing Broker, Worth Clark Realty on Tuesday July 21, 2020

With the number of homebuyers outweighing the number of houses being listed for sale this season, more and more people are facing bidding wars. Whether you’re buying a home or selling your house, DM me to talk about how we can simply and effectively navigate this process together.

Show Special Offering Details ...